To date, the implementation of Protecting Your Super (PYS) and Putting Members Interests First (PMIF) legislation has been a long and winding road and this will continue, with even more twists and bends, as the next round of changes come through.

The last two years have seen a myriad of changes to superannuation and its affiliated insurance but in the words of Billy Ocean ‘when the going gets tough, the tough get going’. It’s been great to see the industry take on these changes, to prioritise and protect members’ interests, with focus and determination. The year ahead will be one of the toughest yet, so let’s have a look at what’s coming up in regards to insurance in super.

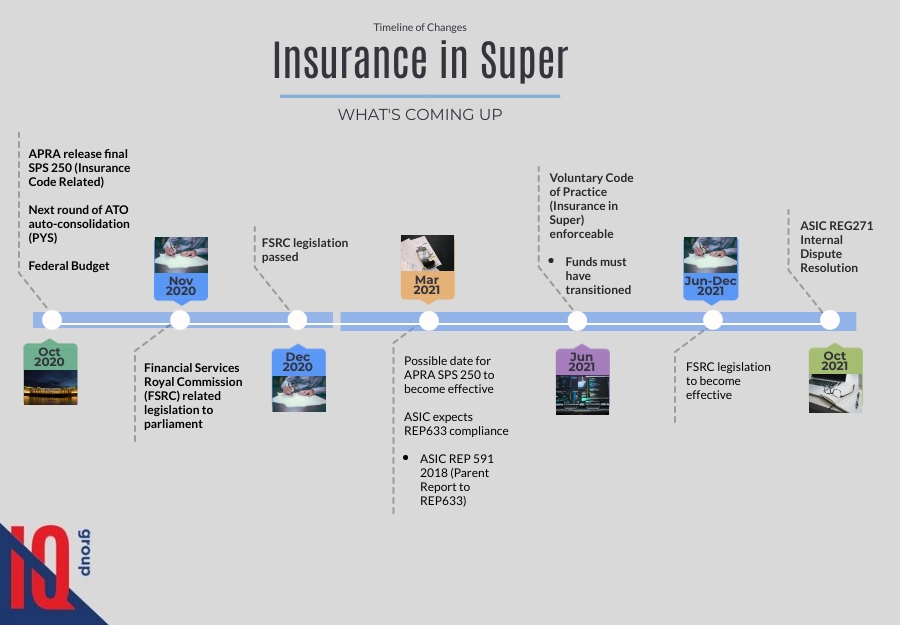

Oct 2020 APRA SPS 515 Strategic Planning and Member Outcomes: annual performance assessment to determine whether the financial interests of the members are being promoted; Federal Budget implications; next round of ATO auto-consolidation (PYS).

Dec 2020 Implementation of various FSRC related legislation: enforceability of industry codes (eg. Insurance in Super Code of Practice), Insurance Claims handling to become a financial service; Universal Terms for Insurance in MySuper.

Mar 2021 APRA SPS 250 Insurance in Superannuation: requirements with respect to making insured benefits available to beneficiaries; Compliance with ASIC REP633: requirements set to provide improved consumer protections which many funds will be able to meet as they renegotiate their insurance policies.

Apr 2021 Design and Distribution Obligations and Product Intervention Powers Regime: Issuers and distributors required to have an adequate product governance framework to ensure products are targeted at the right people (this regime will affect almost all areas of the financial services industry).

Jun 2021 Insurance in Super Voluntary Code of Practice becomes binding and enforceable and funds must have transitioned and be compliant before this date.

Oct 2021 ASIC REG271 Internal Dispute Resolution: financial entities must meet ASIC’s standards and requirements for Internal Dispute Resolution systems and have an AFCA membership.

Dec 2020-21 Financial Accountability Regime: extension of accountability requirements to other APRA-regulated entities and directors/senior executives in accordance with the government’s response to the FSRC recommendations.

Ongoing AFCA implementation and compliance

Unknown Potential creation of a co-regulatory model for industry codes: Under a co-regulatory model, industry participants would be required to subscribe to an ASIC approved code and, in the event of non-compliance with the code, an individual customer would be entitled to seek appropriate redress through the participant’s internal and external dispute resolution arrangements.

As well as ensuring compliance and implementation of all regulatory and legislative changes, super funds will still be dealing with the continuing ramifications of COVID-19. IQ remains focussed on helping our clients navigate these changes and cut through the complexity of the year to come, supporting them to achieve the best outcomes for their members.

The insurance world keeps turning and regulations and standards are constantly evolving, but members still need their insurance and funds must continue to put members interests first, in everything they do.

By Kiara Leslie (Graduate Consultant) and

Sharon Campanaro (Principal Consultant and Head of Change and Learning Services)

Recent Comments